Company Profile

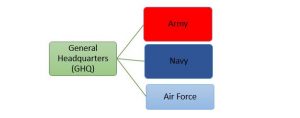

Services Integrity Savings and Loans Ltd (SIS&L) is a privately-owned financial services company which was licensed by Bank of Ghana (BOG) in May-2016. The company started operations in January,2018, offering an array of services including Savings & Investment, Fund Management, Lending and E-banking services. SIS&L is sponsored by the Ghana Armed Forces (GAF) through their Provident Fund (GAF-PF). GAF comprises the Army, Navy, Air Force and their Civilian Employees.

Services Integrity Savings & Loans Ltd serves the public and business community with special focus on the Officers, Men and Civilian Employees of the Ghana Armed Forces and their immediate families. We are committed to providing cutting-edge products and services to improve the welfare of servicemen and their families during and post service to ultimately enhance the economic growth of the country. Our objective is to have presence in all garrisons across the country with robust e-banking support for convenience.

For the Military, SIS&L was set-up on the following key pillars:

- Mortgage Financing

- Loan Refinancing

- Spousal Support

- Personal and Other Loans

- Deposits, Savings and Investments

SIS&L dares to be different in providing unique, secured solutions to customers’ needs on the back of visionary leadership, innovative and committed staff, strong customer service and robust banking technology.

SIS&L’S JOURNEY SO FAR

In March 2011, the Military High Command of the Ghana Armed Forces (GAF) under the leadership of the then Chief of Defence Staff, Lieutenant-General Augustine Blay decided to embark on a bold attempt to better the economic fortunes of the rank and file of the Ghana Armed Forces. It was the idea to have a company established to cater for the financial needs of GAF as an institution as well as its personnel to make a significant contribution to the economic growth of Ghana. GAF comprises the Army, Navy and Air Force.

Two years prior (in 2009), the High Command had introduced a compulsory Provident Fund where each personnel of GAF was mandated to save a minimum of 5% and a maximum of 20% towards the creation of a fund towards retirement. The funds had accumulated over GHS 60 million and the High Command was looking for a means of investing these funds in such a way that would result in real wealth creation for the servicemen. The High Command noted that Military Banks elsewhere in the world had helped elevate the standards of living of Military personnel. It was then decided by the Military High Command to explore the possibility of the Military setting up a Bank.

A feasibility study on the establishment of a Military Bank presented to the Military High Command in May, 2012, received a favourable response and in January, 2013, the Armed Forces Council approved the establishment of a financial institution which would assist in providing for the welfare of the military personnel and their civilian counterparts.

The first step involved in the establishment of the financial institution was the incorporation of a company (vehicle) “Services Integrity Limited”. However, before the application for a banking license could be submitted to the Bank of Ghana, there was an increment in the minimum capital contribution of banks from sixty million cedis (GHS 60 million) to one hundred and twenty million cedis (GHS 120 million) which caused a review of strategy to a 2-stage approach of establishing a Savings and Loans Company first and then a conversion to a Universal Bank later. A change in name of the Vehicle then took place from “Services Integrity Limited” to “Services Integrity Savings and Loans Company Limited” with a Certificate of Incorporation (No CS439922014) issued by the Registrar-General’s Department in June, 2015.

On April 21, 2016, the Bank of Ghana issued an approval for the Final License to Services Integrity Savings and Loans Ltd to operate as a Savings and Loans Company. The company was inaugurated on December 1, 2017 and commenced operations on pilot basis in the same month. Services Integrity Savings and Loans Ltd eventually opened to the public fully in January, 2018.

The key promoters of Services Integrity Savings and Loans Limited (SIS&L) were the Ghana Armed Forces High Command initially headed by the Chief of Defence Staff (CDS), Lieutenant General Peter Augustine Blay and his other Service Chiefs – Major General J. N. Adinkrah (Chief of Army Staff), Air Vice Marshall Michael Samson-Oje (Chief of Air Staff), Rear Admiral Matthew Quashie (Chief of Navy Staff) and Commodore Geoffrey Mawuli Biekro (Chief of Staff). Successive High Command Officers have also provided their unflinching support to the Company.

The first Board of Directors of the company comprised the following:

Director |

Role |

Status |

| Major General Richard Opoku-Adusei (Rtd) | Chairman | Resigned |

| Brigadier General Anthony Adokpa (Rtd) | Executive Member | Resigned |

| Mr. Sebastian D.K.N Gavor | Executive Member

(Outgone CEO) |

Resigned |

| Mrs. Lydia Daddy | Executive Member | Serving |

| Major Amarkai Amarteifio (Rtd) | Non-Executive Member | Serving – current Chairman |

| Colonel Daniel K. Amissah | Non- Executive Member | Serving |

Mr. Sebastian D.K.N Gavor was appointed the first Chief Executive Officer (CEO) of Services Integrity Savings and Loans Ltd; a position he held from July 2016 till July, 2019 when he retired. He was assisted in leading the institution by a team of visionary advisors in the persons of:

Brigadier General Anthony Adokpa (Rtd) – Technical Advisor

Mr. Evans Kofi Bayitse – Advisor, Human Resource and Administration (He held this position from August 2016 till July,2019),

Mrs. Lydia Daddy – Advisor, Risk

Vision & Mission

Vision

Services Integrity Savings & Loans Ltd seeks to be the leading financial institution where every cedi of every customer works for them in wealth creation and ultimate economic growth.

Mission

To be the primary financial institution of choice for our customers using technology-driven solutions and encouraging thrift, maximize shareholder value and provide a rewarding career for employees.

At SIS&L, we say we are the “PFIC – Primary Financial Institution of Choice”.

Core Values

-

Integrity

- We are sincere, trusted, transparent, accountable, dependable and reliable

- Our word is our bond

- Our customers value our integrity

-

Professionalism

- We hold ourselves to extremely high professional standards and anything less than excellent is unacceptable

- Every employee is highly qualified, is an expert in what he does and continually updates his knowledge, skill and expertise

-

Innovation and Distinction

- Our commitment is to continuous improvement and continuous adventure

- We promise to think about it before anyone else does

- We dare to be different in our attitude, commitment, loyalty and service

- We are brave, bold, fearless and courageous

-

Customer-Oriented Focus

- We exceed customer expectations

- Every customer is an SUV – Special, Unique, Valued

- Every Customer is treated as his needs demand

- We are attentive to customer requests and client complaints

- We are responsive to customer financial needs and requests

-

Employee Passion

- Pleasure in the job puts perfection in the work

- Passionate workers are committed to continually achieving higher levels of performance

- Passionate workers can drive extreme and sustained performance improvement

- The secret to long-term, consistent success for business is to have passionate employees that are consistently working towards big goals and thinking big

- Employees are passionate about the needs of customers and desire to satisfy them

Board of Directors

The Board of Directors of SIS&L represents and promotes the interests of shareholders. They have overall responsibility for SIS&L, including approving and overseeing the company’s strategic objectives, risk strategy, corporate governance and corporate values.

| Personnel | Role |

|---|---|

| Major Amarkai Amarteifio (Rtd) | Board Chairman |

| Major General William A. Ayamdo | Non- Executive Member |

| Rear Admiral Peter K. Faidoo | Non- Executive Member |

| Brigadier General Daniel K. Amissah | Non-Executive Member |

| Chief Warrant Officer Ramous Barker | Non- Executive Member |

| Mrs. Lydia Daddy | Acting CEO |

| Mr. Thomas F. Senya | Non- Executive Member |

Management Team

SIS&L’s Top Management oversees the institution’s overall performance and delivery. It focuses on strategic leadership, management and direction whilst ensuring the most effective prioritization of resources and maximization of shareholders’ returns.

| Personnel | Role |

|---|---|

| Mrs. Lydia Daddy | Acting CEO |

| Mr. Collins Appiah | Manager – Treasury |

| Issah Adam, Esq. | Head, Legal |

| Mr. John Dzandu | Head, Finance |

| Mr. Lord M. Dery | Head, Information Technology |